Catch Explosive Reversals & High-Momentum Pullbacks – Before They Happen

Master the exact moment when momentum shifts and order flow dominates using 2 advanced engines built to read wave structure and real-time liquidity in effective sync.

You’re frustrated – because you can see the move… but never catch it early enough.

You’ve probably experienced this:

• You react too late – the best part of the move is already gone.

• You chase momentum… only to enter right at the exhaustion point.

• You get faked out by liquidity sweeps that look like real breakouts.

• You try to read candles manually, but the market moves faster than your analysis.

• You get stuck trading during slow, low-quality conditions that kill your R:R.But here’s the real problem:

• Your tools show you price movement – but not what causes the movement.

• They don’t read momentum velocity.

• They don’t tell you which side holds true volume power.

• They don’t reveal the transition from weak to strong order flow.And without that, you’re always one step behind the real move.

Introducing 2 specialized indicators – each built on its own breakthrough trading mechanism

Dynamic 3-Wave AnalyzerImpulseWave Radar uses the Dynamic 3-Wave Analyzer mechanism, analyzing three consecutive waves (W0 → WI → WR) and confirming that the impulse wave (WI) has stronger momentum than the base wave (W0) using ticks-per-second.This ensures only high-quality signals are triggered, while the real-time momentum gauge tracks price speed, confirming strong trends and filtering out weak setups.Click here to learn more about ImpulseWave Radar ↓

Order Acceptance BoxRomantick Pulse uses the Order Acceptance Box mechanism to analyze order flow at the candle level. It detects liquidity sweeps by reading volume distribution, drawing a box to highlight areas of high BUY/SELL volume concentration. By comparing the volume within the box to surrounding candles, it identifies which side (BUY or SELL) dominates, filtering out weak signals.This mechanism triggers precise BUY or SELL signals based on dominant volume and delta, ensuring high-quality, low-risk entries at potential reversal points.Click here to learn more about Romantick Pulse ↓

ImpulseWave Radar: Momentum wave scanner

Wave structure detection

What It Does: Reads the base wave (W0), impulse wave (WI), and pullback wave (WR) in real-timeWhy It Matters: Filters out random noise and market chopResult: High-quality entries at the strongest part of the trend

Momentum speed validation

What It Does: Measures ticks-per-second acceleration of price movementWhy It Matters: Confirms which waves are backed by actual order flow powerResult: Only alerts when momentum is truly explosive

Correction health check

What It Does: Analyzes pullback speed and structure qualityWhy It Matters: Distinguishes safe pullbacks from dangerous reversalsResult: Boosts confidence to hold trades longer

Continuation confirmation engine

What It Does: Detects ticks/s spikes showing strong buyers or sellers stepping inWhy It Matters: Confirms your entry aligns with high probabilityResult: Cleaner trades with better risk-reward ratios

Romantick Pulse: Order flow reversal detector

The optimal indicator for catching reversals at the exact turning point. Romantick Pulse reads per-candle dominance to identify where institutions are stepping in – giving you ultra-tight stop placements and explosive entry timing.IMPORTANT NOTE: Indicators like Romantick Pulse typically require Tick Replay to function at full accuracy. However, ninZa.co has developed a new proprietary technology that allows this indicator to operate smoothly and efficiently – without using Tick Replay at all.

Volume Box mapping

Automatically identifies the zone with highest buy/sell volume inside each candle. Shows which side truly controls price action, eliminating emotional guesswork entirely.

Liquidity sweep detection

Identifies institutional stop hunts at key highs and lows. Captures perfect reversal entries right at the turning point with minimal drawdown exposure.

Delta + Volume confirmation

Confirms whether price is reversing with real institutional force or just retail noise. Filters out weak reversals that trap amateur traders.

How to effectively combine ImpulseWave Radar with Romantick Pulse

Step 1: Let ImpulseWave Radar Find the impulse waves

Wait for ImpulseWave Radar to detect a strong impulsive wave (WI) in one direction – for example, a powerful bullish push.→ This tells you:

“Momentum is heating up here. This is where a new leg could start.”

Step 2: Look for healthy Pullback inside the impulse

Allow price to form a retracement wave (WR) that stays inside the body of WI.→ This confirms the move is not collapsing, but simply pulling back before a possible continuation.

Step 3: Let Romantick Pulse confirm order-flow dominance

Now bring in Romantick Pulse:

• For a BUY setup: after a bullish impulse, wait for Romantick Pulse to detect buy volume dominance (liquidity sweep + strong buy volume box + positive delta).

• For a SELL setup: after a bearish impulse, wait for clear sell volume dominance (sweep of highs + strong sell volume box + negative delta).→ This step confirms that the dominant side (Buy or Sell) is really in control, not just moving price mechanically.

Step 4: Trade only when both agree (confluence)

Enter only when:

• ImpulseWave Radar shows a strong impulsive wave + healthy retracement, and

• Romantick Pulse prints a clear BUY/SELL signal with volume and delta confirmation.→ When both fire together, you have confluence between price action + volume, which dramatically increases the reliability of the setup.

Step 5: Execute the trade near the “Root” of the move

Use Romantick Pulse’s optimal entry to:

• Enter near the origin of the next wave,

• Keep stop loss tight,

• And let the impulsive structure from ImpulseWave Radar guide your target.

Session map: How our pro trader use Romantick Pulse + ImpulseWave Radar on ninZaRenko 64/16

Many traders have asked how these two indicators work together on larger Renko structures.IMPORTANT NOTE: This isn’t trading advice – it’s simply how he personally studies market behavior, and how this chart has become his “GPS” for understanding the session’s direction.

What he notices on the 64/16 ninZaRenko

Romantick Pulse reveals the true control point

Almost every RP signal highlights where real absorption or a liquidity sweep occurs.The volume box inside the candle clearly shows where aggressive buyers or sellers stepped in – and that level becomes a key decision zone for the rest of the move.

Price almost always pulls back into that value zone

After an RP signal prints, price tends to return to the POC, the high-volume area, or the mid-body of the candle.This pullback is where the market “resets,” and it’s the first place he starts paying close attention.

A 2nd RP signal often confirms the true direction

When a follow-up RP signal appears in the same expected direction, it feels like the market is revealing its intent.This second confirmation is often where the next swing begins to make sense.

ImpulseWave Radar helps identify the valid impulse wave

When an IWR signal aligns with what RP has already hinted, the entire structure becomes clearer.It confirms which impulse is real and which impulses are just noise.

How he personally uses this combination

He doesn't execute trades on the 64/16 – instead, he uses it as his session map.A higher-timeframe guide that gives him:

• structural direction

• key levels

• shifts in control

• valid impulsive waves

• clean reversal points→ It shows him the “bigger hand” behind the smaller movements.

Where he takes his trades

The large Renko chart gives him the idea. The smaller bars give him the execution.His real entries are on:

• 20/5

• 12/4→ This approach keeps him aligned with the higher-timeframe narrative while letting him enter with tight stops and better precision.

The pattern he keeps seeing

The flow usually looks like this:RP → Pullback Into Value → RP Confirmation → ContinuationAnd when ImpulseWave Radar aligns with this structure, the wave becomes even easier to read – often much cleaner than traditional price-action methods.→ If you’re a trader who loves studying larger Renko structures, institutional behavior, or order-flow-driven reversals, this combination on 64/16 has been surprisingly clear and consistently informative.

Real trades, real results

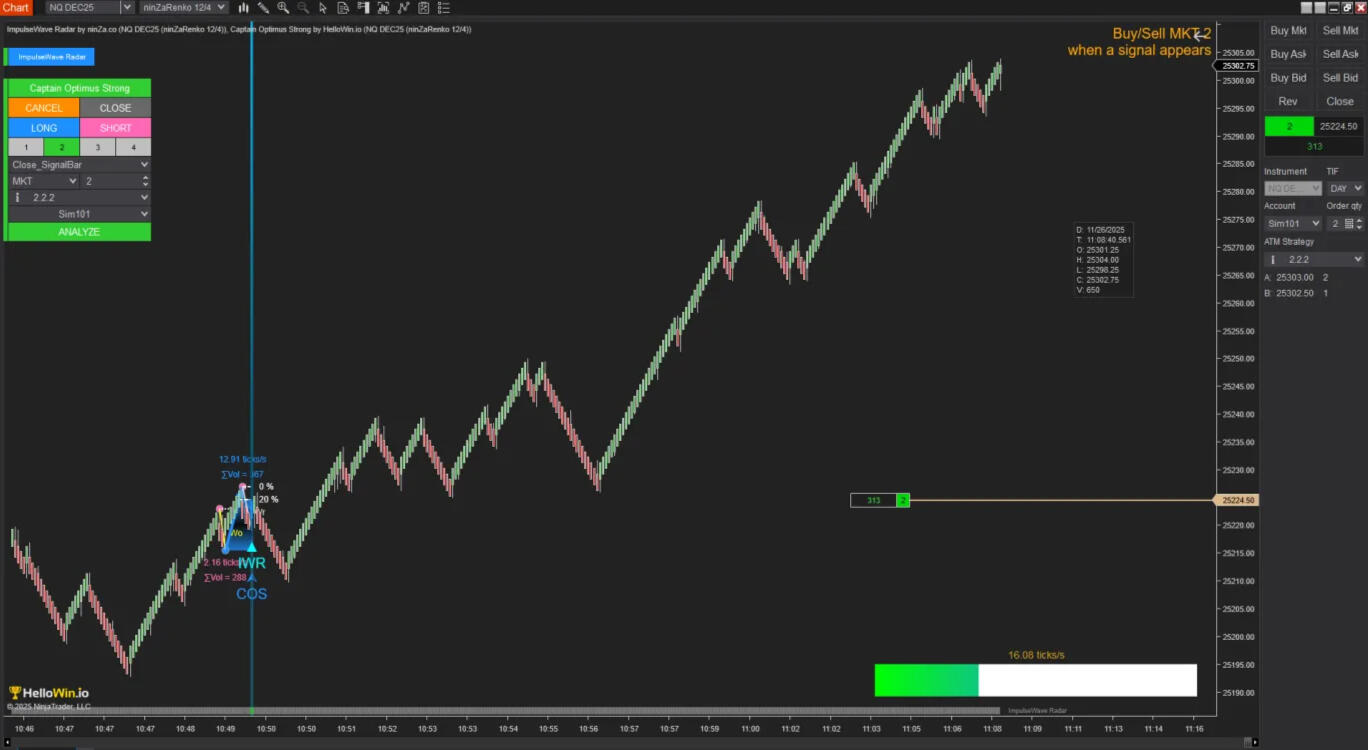

In this recording, ImpulseWave Radar delivered 28 consecutive accurate signals within just 2 hours, clearly showcasing its precision and real-world performance.

This video includes the following sections:

• A quick overview of how ImpulseWave Radar generates signals.

• Live trading examples using the indicator.

• A visual highlight of early-wave signals that offer high reward.

Check out the latest 1-month & 2-month backtest results of ImpulseWave Radar on the 100-tick NQ chart:

ImpulseWave Radar caught a real-time high-reward signal. One trade, +300 ticks! 🚀

Look how ImpulseWave Radar's signals align with Captain Optimus Strong's signals:

This video includes live trading examples using Romantick Pulse:

Real feedback from serious traders:

Your questions answered

Enjoy massive Year End offering today

ImpulseWave Radar only

• (1) ImpulseWave Radar license: $700 value

• Personalized support: $50 value

• 1-year product update: $140 value→ In total: $890, now only...

$278

Year End mashup

• (1) ImpulseWave Radar license: $700 value

• (1) Romantick Pulse license: $600 value

• Personalized support: $50 value

• 1-year product update: $260 value→ In total: $1610, now only...

$396

Romantick Pulse only

• (1) Romantick Pulse license: $600 value

• Personalized support: $50 value

• 1-year product update: $120 value→ In total: $770, now only...

$238

45-day confidence guarantee

Zero Risk. Total Confidence.Try the complete indicators in real market conditions for 45 days. Test it on your preferred platform. Run it on your favorite markets. Use it with your trading style.If you don't feel a measurable improvement in clarity, timing, or risk-reward ratios – we'll exchange it for ANY indicator you want with little to no fee.

Because of the overwhelming support from our traders, and our desire to help more traders access this powerful combo at the best possible price, we’ve decided to extend the $396 offer for this bundle.

Lock in the amazing Year End price today

This exclusive bundle pricing will be extended for the first 100 copies, or when the countdown finishes. After that, the price jumps to $426 – and may increase further as we add new features and training materials.Secure your access now and start catching the moves you've been missing.